I went over a bit of strategy in tonight's report for those not already in. I'm going to go over stats and cyclical structure for the remainder of the C-wave in tomorrow's report.

For those of you thinking about getting side tracked by a meaningless daily cycle low that is coming due, let me tell you from bitter experience the one thing you don't want to do is lose your position at the beginning of a C-wave or C-wave continuation.

At this point the daily cycle corrections aren't profit taking opportunities. That will come as we near the end of the C-wave.

At this time a daily cycle low is a last chance opportunity to get as invested as you are comfortable with, whether that be 50%, 75% or 100% will be up to each individual.

Don't forget in bull markets and especially during aggressive C-wave advances the surprises come on the upside. Daily cycles can and often do run exceptionally long as a C-wave starts to gain momentum so losing ones position in an attempt to "time" a short term correction can potentially cost one many percentage points. It's just not worth the risk. This is the time to heed "Old Turkey's" advise.

Folks I have no doubt this will be the greatest bull market that any of us will ever see in our lifetime. Since November of `08 the precious metal sector has been doing everything but hit investors over the head with a pipe to let us know this is the leading sector of this bull.

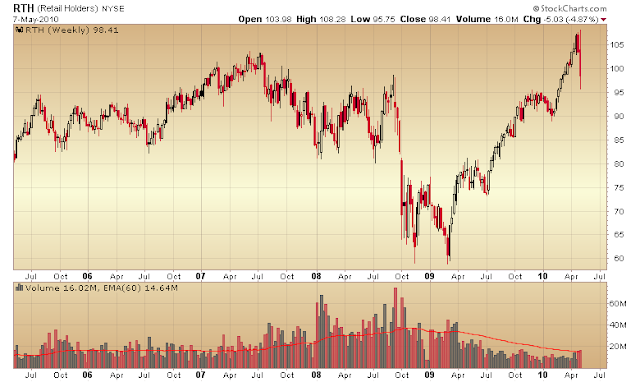

Miners are the only sector exhibiting massive accumulation.

Compare the above chart to other sectors during this bull and you will see where the smart money has been positioning.

These are just a few sectors, but the picture is the same no matter where you look. Steadily declining volume. Only miners are showing heavy accumulation.

Once the HUI & silver join gold, platinum and palladium at new highs the entire precious metal sector will move into a vacuum with no overhead resistance.

That is going to be incredibly bullish for the sector.

Question: what do we make of the dollar strength? You were calling for a significant pullback in the dollar awhile ago, no? Can the dollar and the gold go much higher together? My feeling is that yes they can but I'd like to hear your opinion. Thanks.

ReplyDeleteThe dollar is still overdue for an intermediate decline. I'm kind of leaning toward Mondays high signalling that top but we will just have to wait and see.

ReplyDeleteObviously gold is ignoring the illusionary dollar strength. At this point it looks like we are going to get a C-wave continuation no matter what the dollar does.

I have more money to put to work, so my questions are:

ReplyDelete1) do I wait for a pullback?

2) which is the stronger long term play, silver or gold?

Silver by far.

ReplyDeleteHere is your problem. In bull markets and especially in C-waves the surprises come on the upside.

That often results in extended daily cycles. The current cycle is on day 16. Most run about 20-25 days trough to trough. So in theory gold should form a short term top soon. But if this turns out to be a long cycle it could go for another week or more before topping and you could sit and watch a significant move pass you by.

Those that were out today watched the majors leave them behind by 6%. It's kind of tough to watch those kind of gains and be on the sidelines for no other reason than you are worried about a short term drawdown.

I've tried and tried to get this point across. This is a secular bull market. It has a long way to go. The bull will correct any timing mistakes.

The safest way to play it is to just get in and quit thinking like a trader. But if you must then get some kind of position now and then wait for the next daily cycle pullback before adding the rest. But do so with the understanding that you may miss a big move in the process.

So decide whether it is worth it to you to miss a move on the chance that you might score a better entry.

Hey Gary,

ReplyDeleteIt sure is feeling like synergy is building for a C-Wave advance. The last few days have been nothing but fun. My portfolio is at all time highs. Thanks for the insights. I'm currently at a 50% percent mix of silver, and miners (Split between GDX GDXJ SIL and SLW). I'll add another 6-7% in Miners tomorrow, and then wait for a reversal low;; on the daily chart to add another 20%. I always like to keep a bit of cash on hand, call it superstitious. :)

Mitch

Question Gary,

ReplyDeleteyou said gold would be overvalued when it reaches 1-1 with the dow. when i look at historical data some people say it reached 1-1 in 1930 but some people say the ratio bottomed at 2-1, which is correct?

at what point do u think it's risky to press bets on the long side?

Tom,

ReplyDeleteThe 30's reached about 2:1.

The swings on each side have gotten bigger. in the 30's it went from 20:1 to 2:1. In the 70's it went from 28:1 to 1:1. This time it's coming from 42:1 and I expect it will reach at least 1:1 but I won't be the least surpised if gold gets slightly more expensive than gold this time.

Maybe .75:1.

Gary, do you think this might be a good time to get some options? How far do you think would be appropriate. I am thinking deep ITM GDXJ and SLW out to Nov/Dec. Trying to gain some leverage without paying too much time premium.

ReplyDeleteI am not going to buy options at this time because gold is deep in the intermediate cycle. The best time to buy options is at the beginning of an intermediate cycle.

ReplyDeleteOur best shot at that was in Dec. unfortunately that turned out not to be an intermediate bottom.

At this point the only time I would be willing to buy options would be at the bottom of a D-wave in preparartion for an A-wave.

But how does that square with your conviction that we are in the C wave? If we are in a C wave, is it not very very likely that we will be higher before November than where we are now? In that case deep ITM options that have a very small time premium should do ok, no?

ReplyDeleteYou do realize that just because this "should" be a C-wave doesn't in any way guarantee that it will?

ReplyDeleteIn my opinion it's too late to use leverage. It's up to you if you want to ignore me.

Not at all Gary. Thanks for your opinion. I asked because I value it.

ReplyDeleteI have core miner positions from Jan/Feb. Was just wondering if I should add leverage. I guess I'll just add a bit more SLW/GDX stock.

I fully agree that it is very possible that gold continues higher.

ReplyDeleteMeanwhile, the 'Test' article posted previously suggests your downward bias Gary, which I completely agree that more downward action is still coming in the markets. I believe we are presently finishing the B wave of EW's ABC correction in the markets. * Don't buy in the EW's B-wave for the markets! * This means that if the markets do correct , it will likely bring down miners and gold, right?

Don't you agree that we should continue waiting to enter both the market and gold and miners???

The market is up in the air. It should test the lows but then again it should not have recovered the entire crash candlestick either.

ReplyDeleteMiners I'm already in so I don't have to sit and watch a rally get away from me.

Like I said earlier if you think like a trader then you can miss big chunks of the rally trying to avoid a meaningless drawdown.

That's up to you. Little drawdowns don't bother me so if I wasn't in I would just get in and then go on vacation for a month or two.

Gary, If this is a C wave continuation, how long in terms of time period do you think it will go and what is your target price on gold.

ReplyDeleteI'm going to cover that in tonight's report

ReplyDeleteWhatever happened to all the haters that were hanging out here a couple of months ago?

ReplyDeleteLOL As usual the G-man gets the last laugh.

Hi Gary,

ReplyDeleteYou talk about the next daily cycle pullback. What type of pullback are you looking for? What price range might we see gold dip to?

Thanks for all your work!

There is no way to guess at the magnitude I just look for a swing low in the timing band for the cycle bottom. We still don't even have a top yet.

ReplyDeleteLike I said this is not a profit taking opportunity. It is an opportunity to add or get in.

Anyone trying to get "cute" now didn't learn a thing from what happened last fall.

Anyone knows if TRGD is still alive? I do not see any trades since May 5th.

ReplyDeleteTrading has been halted but I haven't been able to find out why.

ReplyDeleteI'm not disciplined enough to ride the bull. I just have to admit that to myself. I bought low in Feb and liquidated. I'm just too impatient.

ReplyDeleteMy new plan is to accumulate a boatload of silver bullion with the intention of selling it retail if and when a public buying phase occurs as the bull runs.

If I can't click my position away I think I'll be able to hang on.

What do you think, Gary? Others?

That is absolutely the best plan for mouse clickers.

ReplyDeleteGary, Is it still a good time to buy, after several days of heady gains! Scared of buying a top. How would you split capital across GLD, SLV, GDX and GDXJ. How long can current C wave continuation run.

ReplyDeleteI think China's property bubble is about to come undone and likely Canada's and Australia / New Zealand's right along with it. Needless to say this will be a huge deflationary force. If QE and bailouts come along quickly enough it could be fuel for PMs, if not it could be a panic sell.

ReplyDeleteAccording to Fidelity TRGD has been de-listed. Sounds like a goner.

ReplyDeleteanon,

ReplyDeleteyou should at least get some kind of position. One that you can hold on to through a drawdown.

Tara Gold not delisted...suspended.

ReplyDelete"Tara Gold Appoints Mr. David Bizzaro as Chief Financial Officer

05/12/2010

Download this Press Release

CHICAGO, IL -- (MARKET WIRE) -- 05/12/10 -- Tara Gold Resources Corp. (PINKSHEETS: TRGD) (FRANKFURT: T8N) is pleased to announce the appointment of Mr. David A. Bizzaro as the new Chief Financial Officer ("CFO") of the Company, effective immediately. Mr. Clifford A. Brown, the outgoing CFO, will now be employed as Controller of U.S. operations.

David is currently the Founder and Managing Partner of The IFC Group which provides outsourced international controllership services to middle market companies. Tara Gold contracted the IFC Group, on March 3, 2010, with a mandate to bring Tara Gold's financial reporting into regulatory compliance and enhance overall financial reporting standards with the objective of ensuring that the Company's audited financials will be filed on a timely basis. David has been personally leading this effort and expects the internal financials, for the periods up to and including December 31, 2009, to be handed over to the auditor by May 31, 2010.

On May 6, 2010 the Securities and Exchange Commission temporarily suspended the trading in the securities of a number of corporations, including Tara Gold, due to the failure of these corporations to file 10-K and 10-Q reports with the SEC. Tara Gold is working diligently on the process of preparing its delinquent 10-K and 10-Q reports and plans to file these reports with the SEC as soon as possible. As outlined above, Tara Gold had already initiated efforts to meet its financial reporting obligations and is determined to achieve full compliance in an expeditious manner. "

see here: http://www.taragoldresources.com/English/News/PressReleases/PressReleaseDetails/2010/Tara-Gold-Appoints-Mr-David-Bizzaro-as-Chief-Financial-Officer1122025/default.aspx

Gary

ReplyDeleteCare to speculate a price target for gold this year.

150.00, about 25% higher for this year sound reasonable.

http://timsmarketblog.blogspot.com/

I am going to offer a guess in tonights report.

ReplyDeleteWhy oh why are the miners still below their highs for the move and gold is at new highs. Shouldn't the miners lead 2 to 1.

ReplyDeleteThey have been leading since the Feb. bottom.

ReplyDeleteAt the moment I think the miners are sniffing out an impending short term correction into a daily cycle low.

I put the rest of my money to work today, and I was disappointed (but not surprised) that the new money all ended up in the red. But then I remembered that the reason I was behind the curve is that the market was gapping on overnight trading, and I had no way to get in on that rise.

ReplyDeleteI'm ready for the ride!

Be prepared to hold through a short term drawdown. Gold is now in the timing band for a daily cycle low.

ReplyDeleteWhether that starts tomorrow or another 10% higher is anyone's guess. But taking a position and then stopping out of it immeidately is no kind of strategy.

Thanks Gary,

ReplyDeleteNo I've absorbed all of your lessons, but it's not always easy to implement them. Today's addition to my positions was less than half of my final position.

I would have added that money yesterday, but the market popped in the morning and never looked back, so I ended up waiting until today to add. The market popped in the morning again, but I went ahead and added. This time, however, it pulled back at the end of the day. Sigh.

I'm holding onto what I've got and I'll wait out any pullbacks. I've watched you for nearly a year, and it's all sunk in intellectually, but the hardest part is acting against my emotions.

Yes those damn emotions do tend to get in the way :)

ReplyDeleteLike I always say if you have trouble holding on the best solution is to just load up on physical silver.

From Zero hedge:

ReplyDeleteFirst Gold, Now Europe Running Out Of Silver

Tyler Durden's picture

Submitted by Tyler Durden on 05/12/2010 16:20 -0500

* Germany

* Sovereign Debt

Earlier we noted that the Austrian mint was on its way to depleting its gold reserves following "panicked buying" from Europeans, who now openly fear the demise of their currency. Now, courtesy of Slim Beleggen, we understand that the situation in the silver market is just as bad and has also spilled over to Germany: the contagion is no longer one of sovereign debt, but of precious metal physical inventory. The primarily silver focused (but holding gold as well) Kronwitter precious metal online retailer is not only not accepting any orders, but has entirely taken down its website.

The only message left for visitors is (translated from German) as follows:

Dear customers, due to the enormous number of orders we can take at the moment no new orders via the Internet, email or fax contrary. All previously purchased and paid for coins are shipped. In order not to delay the extradition unnecessary to ask is to refrain from requesting payment or tracking number. When shipped our you will automatically receive a shipping confirmation. We hope to do everything within two days and then re-open the shop to buy. Thank you for your understanding. Marie-Luise Kronwit

Soon coming to an LBMA vault near you - a run on physical and a total collapse of the 100x diluted Precious Metal market.

http://www.zerohedge.com/article/first-gold-now-europe-running-out-silver?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

I mentioned the behavior of your typical middle class German. Given what happened since last summer, I am not surprised.

ReplyDeleteFear of inflation is deeply ingrained in the German psyche even with people who are 50-60-70 and never experienced the 1920s.

Interesting observations about the German psyche, Frank, and thanks for sharing.

ReplyDeleteIt really is an amazing country, to be once again be so strong. Everything I read about the Euro collapse suggests Germany is the only "go to" country. It's especially noteworthy because of how badly Germany was decimated before and after WWII.

Makes me wish I was fully invested in gold as your friends and Gary are doing.

Next pullback, I'll add the other half of my portfolio, now that I have a significant cushion.

Gary, Can you please share your price target for current C wave continuation and time frames. Thanks.

ReplyDeleteAnonymous said...

ReplyDeleteGary, Can you please share your price target for current C wave continuation and time frames. Thanks.

Anon .. i believe thats what the subscription is about.

Peter

I hate to sound negative but I sold a bunch of pm positions yesterday, IAG, NXG, SLW and half of my PAAS (still holding HL).

ReplyDeleteMaybe this is just a short-term top but the miners go down 2-3 times as much as gold so I plan to get out of the way and buy cheaper. The constant yammering on CNBC about gold and how to get into it (every few minutes it seemed) was a factor but mainly has anyone looked at a chart of gold in euros? It looks like a rocket ship! Just not sustainable. Most just see a $gold chart. IMO gold will be a buy when it comes down from 980 euros/oz to 900 or so.

Best to all

The EUR has been over-priced by PPP and other metrics for a long time. Now that the ECB is going to apply QE then the EUR should plummet.

ReplyDeleteIn Jan 1999 the Euro was born at 1.18. I still use that number as guidance.

Dear Anonymous,

ReplyDeleteIf you remember the tech and housing bubbles, the real top is always a lot higher than you think it can possibly be.

And just a few weeks ago, the same pundits were declaring gold over, dead, done. It's definitely getting frothy in Euros, but I think that just presages a near-term bottom in the Euro, not a long-term top in gold.

I do think we are now entering the third and final act of the gold bull market. My guess, using the 1970's gold bull as a yardstick, is that we have 2 years left in the bull, 3 max.

FWIW, the classic sign of a parabolic top is a doubling of prices in a few months, a la the first quarter of 2000 in tech stocks. However, you would be wise to sell your PM stocks before then, because the stocks always lead the metals themselves.

Also worth noting that the Gold/XAU ratio is still incredibly high, suggesting that gold stocks are still very undervalued. This is not the sign of a top.

My plan is to wait until Gold/XAU reaches 4.0 (usually the top of the range, though I think it will go even higher when the true mania hits), then shift into the metals themselves for a few months for the final parabolic blowoff...

...and then switch back into a plain-vanilla S&P 500 index fund for the 20-year secular bull market in stocks that will then just be beginning.

Couldn't have said it better myself.

ReplyDeleteThe thing about getting physical silver is the extreme weight. If you have 300K-that's 900 plus lbs, 400k 1200 plus, etc. Gold is much more portable. EX. 400K=20lbs.

ReplyDeleteI'm looking at about 10-20% physical (take possession), 40-50% in Goldmoney or Bullionvault, the rest in miners. I would take delivery of mostly gold, 25-30% would be silver. Then switch those ratios in the GM or BV account.

That is a drawback. Of course the plus is you will make twice as much from silver as you will gold so in the long run it's probably worth the inconvience.

ReplyDeleteMaybe so, but you are a weight lifter so you can only imagine how much freaking silver that would be!

ReplyDeleteFor sure, we need to keep our eye on the Euro now vs. the dollar. I think this has been the fuel to kick things in motion. There's a monthly H&S pattern on the EUR/USD and we just broke the neckline...perhaps we get a back test of the neck line and then go down really hard. The pattern measures out to .84. The fundamentals also support the pattern, so something to keep an eye on.

Know what we all know is coming, in my very humble opinion, everyone who is trading this move should have at least 10-20% in physical gold or silver. If nothing else, you have some insurance should the unthinkable happen. Please read Martin Armstong's recent essays...

http://www.martinarmstrong.org/economic_projections.htm

I see he has 2 new ones up. I had just read "Sometimes the Lunatic Fringe Does Get it Right". In it he talks about hyperinflation and how it's very misunderstood. Bottom line, it can happen in a heartbeat and it's more a function of a complete collapse in confidence in the underlying security of money and the velocity of money explodes causing hyperinflation...not JUST the printing of fiat money. Now, it appears we are in the early stages of this dynamic in Euro and it could be the catalyst to drive the pms absolutely bonkers. The US should be right behind the Euro and any dollar strength now is a false sense of security. Anyway, in such a scenario, all paper is going to be trash...Be it SLW stock or FRNs.

Just some food for thought...Last Thursday was the the final straw for me. Anyone who watched that tick by tick had to be completely spooked by what they saw. I would not want to be 100% exposed to such a strange market.

Cheers.

I think I can say with confidence that there won't be any time in the near future where paper money won't be used as currency. That means you will have to trade your physical for paper before you can buy anything.

ReplyDeleteThe physical thing is nothing more than sensationalism by some radical gold bugs. Fiat currency isn't going away anytime soon and if you want to stay ahead of inflation you will do so much better in mining stock rather than physical gold simply because they will appreciate at a much higher rate than gold.

So no matter how you look at it you will still be able to trade you stock for more paper dollars to buy things than you are going to get by trading an oz. of gold.

Don't let these scare tactics make you lose your good ole fashioned commonsense.

Hi Gary,

ReplyDeleteI believe the USD DXY index has broken to new highs. Am I right?

What can we take from that then?

Many thanks.

I'm not trading the dollar so I guess if your asking me it's meaningless.

ReplyDeleteIf someone wants to trade the dollar they could of course go long based on the breakout.

I seriously doubt the gains in the buck will be even minutely comparable to what one will make in miners though so I don't really know why someone would want to trade it.

Agressive,

ReplyDeleteMy take on the strong dollar is that markets are about to take a second dip to test the lows, as Gary originally thought. The Euro lost everything it gained from the bounce and is headed much lower. Looks like the pound is headed down as well. Markets will tumble again and I'm guessing the central banks will anounce more liquidity measures to stabilzie the currencies, sending PM's higher. Since miners resisted the crash so well, I'm guessing the second dip won't do much to them either - at most they might fill their recent gaps.

Jayhawk, I used to be a mirror image of you. Sell bottoms. Buy tops. Then I just decided to be Old Turkey. When things aren't going as I figured. I take Gary's advice and shut off the computer. I don't hang upside down off rock cliffs, but I find plenty to occupy my time. You sure remind me of what I hated about myself. No offense intended. I just took the advice to ride the bull.

ReplyDeletelowtax and gary,

ReplyDeletethanks for your insights.

-aggressive

Hi Brian-

ReplyDeleteI'm happy to hear I remind you of the thing about yourself you hated the most! ;) No offense taken.

Like others here, I'm a bit newer to this thesis. I became a sub to Gary last summer, read him for several months, attempted to do some trading based on in and didn't have great success and after hearing him hype of the coming spring C wave I decided in Dec. to finally trust his calls in the new year.

So starting in January, I took a decent sized (though not 100-125% as he recommended) position...even added the June calls on SLW and GDX. Obviously, we had a rough Feb and these positions got murdered. I calmly added more during the darker days to my position building it up to 75% or so. I still knew what Gary and others were saying was the right call and I was fully prepared to go old turkey and just forget it. Gary was giving his old turkey advice, telling us to turn off the computers, etc. Then came his D wave call and he sold off his options, then sold off his positions down to 25%. I actually decided not to listen and held on for a month or so longer. Old turkey was working and I was pleased to see some of the positions coming back. At one point, my SLW options were break even and GDX was only down 50%. Many of my Feb stocks were green, things were looking up. I emailed Gary and asked him what I should do. He told me to sell the options and take the loss. I eventually listened to Gary and prepared for the coming D wave and trimmed my stocks way back too. Actually made some cash on my Feb entries and held onto the losers (CDE, HL, SSRI). Eventually sold some of those for a small loss. SO you can see, I didn't buy and the top and sell at the bottom...Only a few positions and actually it was Gary who told me to sell. His D wave spooked me out of holding my other winners longer.

I had a bit harder time trusting his next all in call. Sure, in hindsight he did get this one right but I had some doubt after the first 2 of the year.

I think Gary is a great guy and I like this blog and his reports. I think for my personal make up, I need to have the physical for the bigger % as seeing my accounts in the red is too much for me. I'm going to go with the Aden Forecast as they have a similar thesis, but only send out monthly reports. I think getting daily and weekend reports while fun, feeds my anxiety and increases my temptation to watch all this stuff minute by minute.

It's been a good process. I've learned which stocks I like and I learned about my trading/investing philosophy.

Jayhawk,

ReplyDeleteThe Aden sisters were calling that sell off in December a D-wave as well, long before Gary finally gave up and made the D-wave call. Do you know if the Aden forecast has changed its outlook as well? Are the sisters now calling this a C-wave?

Not sure, I read their free report on their site...It was the Dec issue. Also read a recent article by them on 321Gold. I have not subscribed yet.

ReplyDeleteDon't forget all I did during that time was to lock in profits on winners in case it was a D-wave.

ReplyDeleteThe exception was my two option positions. Those two wasting assets had to be sold unless one was willing to let them expire worthless which would have been the case if this had been a D-wave.

In hindsight holding would have been the correct thing to do but unfortunately we can't trade in hindsight :)

I'm still working on that damn crystal ball but so far I haven't been able ot find the problem :)

GDX's inability to hit new highs while gold is hitting new highs spells trouble for gold.

ReplyDeleteDang! I KNEW I should've cashed out 2 days ago, roughly between 12-1pm!!!

ReplyDeleteI Doubt it. Gold is just due for a daily cycle low and the stock market appears to be going to test the lows. Sentiment is already starting to skew very hevily bearish so once the test is finished the market will be set up for another multi-month rally.

ReplyDeleteI expect once gold puts in the daily cycle low we will see a final big parabolic move to cap the C-wave advance.

These little short term wiggles are meaningless. Not to mention we knew they were coming.

Keep the big picture in focus folks.

Yeah, I was just making light of the pullback.

ReplyDeleteDo you still plan to exit into the C-wave, then buy back? It seems hard to gauge just how far a C-wave could run. I'm liable to just stay in for the entire secular move. It also give me more free time!

I can make more money in life, but can't make more time.

Yes I will try to exit at the top. There are signs to watch for as a C-wave tops. We aren't even close yet.

ReplyDeleteHoly crap...Did anyone buy SVM a few days ago? I thought I was being wise buying some at the open. Down 6% so far in that position. Got some RGLD. Down pretty good chunk already here too.

ReplyDeleteBig picture, big pictture, It's not what it does today or tomorrow. Gold and miners are most likely headed into a cycle low. They are going to correct for a bit.

ReplyDeleteIt's where they go after that as the C-wave really starts to accelerate that counts.

that was enough panic to probably finish the whole decline Gary

ReplyDeleteI'll just watch for a swing low as a sign the cycle has bottomed. But I doubt gold will bottom in only one day. My guess is sometime mid to late next week and probably test $1200 or maybe a little lower.

ReplyDeleteit's gone down for 2 days

ReplyDeleteI think gold made an intraday high this morning.

ReplyDeleteminers should not be positive in this market if gold was not pushing higher in the short term. I think we extend herefor another week or so before we get a drop, makes more sense that way, plus we just flushed out a lot of sellers

ReplyDeleteNice performance by miners in the broad market headwind.

ReplyDeleteA bit frustrated by NXG, which is my largest position now.

SLW is a machine......

>SLW is a machine......

ReplyDeleteA well oiled machine!

Gold crossed the 1000euro line intraday, I guess that was the reason for the premarket run up in gold and than the fade.

ReplyDeleteLets hope that this has a psychology meaning for the peolpe over here. Seeing gold above 1000 is a sign for sure, this could be more fuel in the fire ;).

Concerning SLW it looks like it is THE machine. With this strengh on a day like today and with a chart that screams "Help, I am hopelesly overbought" it looks like it is on its way for a parabolic run. Me hopes HL joins the party soon...

Everyone have a relaxing weekend. The PMs worked hard for us this week. Time to chill.

"The physical thing is nothing more than sensationalism by some radical gold bugs. Fiat currency isn't going away anytime soon ..."

ReplyDeleteGood to read this dose of realism!

Fiat money contributed as much to progress as the industrial revolution. Without it (and credit) we would be where we were 100 or 200 years ago. Who wants to go back? I don't!

It's the system that needs and will to change. Fiat money itself isn't bad, it's how we use it.

Gold isn't money either but it is a store of value, if only because humans want to see it as the store of value by excellence (but other commodities are too).

Fiat money should only be a mean of payment and never be a store of value. That's why Keynes wrote about the death of the rentier.

I see one advantage for physical gold though. You have it with you when they change the system. Maybe my grandma told me too much about the Gutt operation in Belgium after WWII where they needed to hand in their old fiat money in exchange for new and less fiat money, to stall post war inflation (frustrating was that the catholic church received the same amount of money and many people gave their money to the clericals to exchange it; of course they had to pay a fee to the clericals).

http://en.wikipedia.org/wiki/Camille_Gutt (not much there though)

Gary said this but then he said this but then he did this... jayhawk, you sound like a whining child! A man makes he's own investment decisions, even if you blindly follow someone elses call it was your money, your account and it was you who hit BUY. It doesn't matter even if your subscribing to Gary it's you who ultimately makes the investment decsion not Gary so you've no right to moan if it all goes wrong. Take the responsibility, the hit and the lesson and move on, ifyou think that reading Gary is having an unsettling effect on YOUR trading then don't read him!

ReplyDeleteanon-

ReplyDeleteI'm not moaning and I am taking responsibility. I was explaining to the other guy, Brian, my experience over the past several months. He was the one who told me "just blindly follow Gary and shut off the computer" basically. I incorporate Gary's cycle analysis into my decisions because trying to trade these stocks was killing me last year. I was simply pointing out that this year Gary has made a couple calls that would cause a newer sub to question he "next all in call".

Also, I pointed out that it has been a discovery process for me personally the past few months. I've been able to drill down on stocks I would have picked, risk I can tolerate, temptations I am subject to (like clicking the sell button), etc...

My decision is to go the physical route with a decent size position and trade/invest in the miners. These will be longer term holds (years), so the temptation to throw myself off the bull will hopefully go away. I will continue to read Gary's analysis, but I think something bigger picture like the Aden Forecast will serve my particular psychology better.

Great weekend report Gary!

ReplyDeleteThanks!

Sober analysis with horrifying conclusions: http://whitemagicanditsexposure.blogspot.com/2010/05/it-cant-be-any-clearer.html

ReplyDeleteAhh if only it were as easy as looking at lines on a chart.

ReplyDeleteI can't tell you how many of these I've seen since March of 09. And so far every single one of them has been wrong.

Until we start making lower lows and lower highs this remains a cyclical bull market and anyone foolish enough to short runs the risk of getting caught opposite Bernanke's printing press.

Not my cup tea fighting something like that for tiny little gains that can evaporate in the blink of an eye. Especially when it's so much easier to just ride the bull market in gold.

I just can't understand why anyone wants to battle with the market and the Fed, long or short, when there are basically piles of money laying in the corner just waiting to be picked up.

George,

ReplyDeleteIn reference to your link: The long term chart looks like the bottom in 2009 could be the same as the bottom in 74-75. In which case, the direction would be up. Also, if you want to simply compare patterns, look at the market ending around 1977...then look at what gold did for the next few years.

The problem with patterns is they only use historical price and there's only so much you can gleam from this.

The psychological factors, IMHO, are far more important. The loud voices lately seem to be saying buy PMs because easy monetary policies tend to support higher commodity prices (deflation is not to be allowed). Those who say sell PMs are only citing chart patterns. In short, one is saying look at history and the other is saying look at history AND future monetary policies.

I wouldn't trade based only on chart patterns for the life of me. We've seen how obvious T/A patterns can be overrun by the central banks.

The old Dollar Bull here stopping by to say hi. I was buying the dollar a couple months ago and getting flamed here, but I was also was giving the Gold pimps crap myself. Turns out we were both right about our trades, and wrong about dissing the other camp. We are all here to make money so it couldn't have turned out better, congrats. Looks like the game for now is flight to safety in the USD, PM's, and T Bonds. I am about to take the biggest short position in the equity market I have ever had, good luck to all you PM longs.

ReplyDeleteI would caution you against that for now. Sentiment has reached levels that generally spark powerful rallies in either a bull or bear market.

ReplyDeleteWait to see if the market makes lower lows by breaking below the Feb. 5th bottom. If it does then sell into the next rally.

This is how bears get destroyed. They think they have to pick the exact top. Nothing could be further from the truth.

A move from 100 to 20 is an 80% gain. But a move from 80 to 20 is a 75% gain. You see what I'm talking about? There's no need to jump the gun on the short side.

The guys at ITulip have a good view on gold, especially that they dont have any interrest in short term moves. good read for the guys who think they need to trade the gold bull in and out.

ReplyDeletehttp://www.itulip.com/forums/showthread.php?15580-Before-the-FIRE-Gold-Update-Is-1-237-the-new-720-Eric-Janszen&p=161353#post161353

Thanks Alex, Jansen was the guy that woke me up to this problem...I read one of his books early 08.

ReplyDeleteJayhawk

Gary, you mentioned - if we have a new low ( lower than 1044, feb. 5) are we to view the chart drawing a line upwards to where a new low may be somewhere just below S&P 1,065?

ReplyDeleteSo 1,055 might be the breakage of the feb. 5 low and then look for a miner rally before we could short?

We would most definitely not be shorting miners. The preciosu metal sector is still in a secular bull market.

ReplyDeleteI was just pointing out a safer strategy for those who can't resist wasting their time and capital on shorting.

We will just remain focused on the gold bull and making the big money.

Let's go ZSL - Bwave - here we come.

ReplyDeletepH11

About a week ago, we discussed gold topping on a prospective date - "5/14" was the date I gave. Sure enough, it did.

ReplyDeleteIf it does not hold, I'd enter a short order 'only on a gold peak' on 5/27, 6/17 or 7/3/10...

pH11

And for kicks... lol ... let's go ahead and list the potential bottoming dates for gold... (could be hogwash, but here's a shot). More priority should be around the first 2 dates... In fact, I'd buy on both with stop losses set tightly to prevent damages.

ReplyDeleteFriday, July 09, 2010

Saturday, July 17, 2010

Friday, July 30, 2010

Friday, August 20, 2010

Sunday, September 05, 2010

Wednesday, September 22, 2010

Now with low CPI data, we have the deflationists coming out of the woodwork. That is actually bullish because it will justify more printing/QE from Ben.

ReplyDeleteThe two nitwits on Yahoo claim that the Japanese "printed like crazy" and nothing happened. It is simply not true that Japan increased the money supply aggressively.

http://www.pcasd.com/us_not_going_down_japans_road

ReplyDeleteHere is a good article with a long term Japanese M2 chart. I have also argued that M2 (in the US) is not a good measure because it fluctuates due to non-money components like MMMF, but over 10 years it should give a fair insight into monetary conditions.

This chart tells you two things: no monetary deflation in Japan and definitely no "wanton money printing".

As long as the central bank is willing to destroy the currency there is just no way for deflation to win.

ReplyDeleteIf they were so inclined the government could simply print enough money to mail everyone a check for a million dollars.

Sounds ridiculous but hey we are just talking scale. They have already done exactly that with the rebate checks twice now.